Biweekly federal tax withholding calculator

This publication supplements Pub. That result is the tax withholding amount.

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

If you claim the same number of allowances for both state and federal taxes you can use the federal Form.

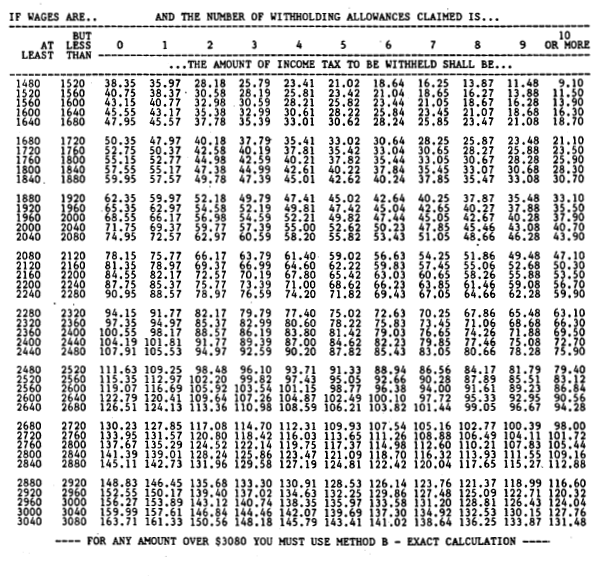

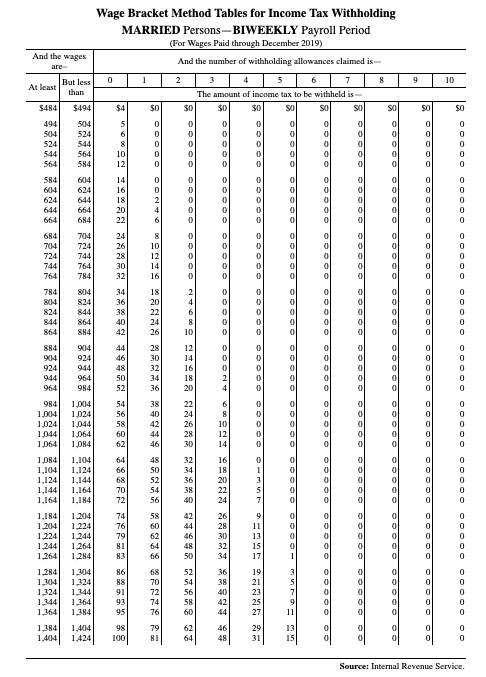

. The wage bracket method and the percentage method. Complete a new Form W-4 Employees. North Dakota relies on the federal Form W-4 Employees Withholding Allowance Certificate to calculate the amount to withhold.

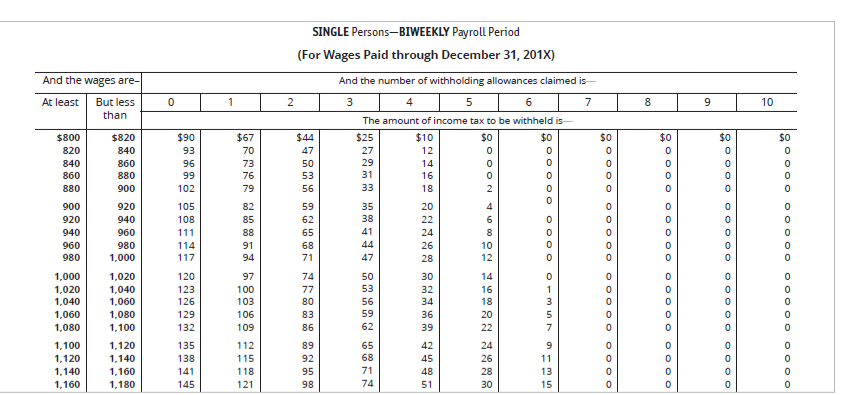

Based on the number of withholding allowances claimed on your W-4 Form and the amount of wages calculate the amount of taxes to withhold. 250 minus 200 50. Form W-4 does not address FICA or Medicare.

Discover Helpful Information And Resources On Taxes From AARP. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. IRS tax forms.

The tool is intended to help you complete Form W-4 to adjust the amount of federal income tax to have withheld from your wages. Calculating Your Federal Withholding Tax To calculate your federal withholding tax find your tax status on your W-4 Form. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. 15 Employers Tax Guide and Pub. Use this tool to.

250 and subtract the refund adjust amount from that. Based on the number of. 51 Agricultural Employers Tax Guide.

For example if your biweekly income equals 1900 you would multiply 1900 by 00765 to find you would have 14535 withheld for FICA taxes. For employees withholding is the amount of federal income tax withheld from your paycheck. If you participate in tax deferred.

Multiply the number of. 2022 Federal Tax Withholding Calculator. The tax calculator can be used as a simple salary calculator by entering your Annual earnings choosing a State and clicking calculate.

It describes how to figure withholding using the Wage. Then look at your last paychecks tax withholding amount eg. How It Works.

The tax calculator can be used as a simple salary calculator by entering your Weekly earnings choosing a State and clicking calculate. Estimate your federal income tax withholding. Minnesota taxes are calculated using the Minnesota Withholding Tax Tables pdf.

To change your tax withholding use the results from the Withholding Estimator to determine if you should. There are two main methods small businesses can use to calculate federal withholding tax. In addition to income tax withholding the other main federal component of your.

This is a projection based on information you provide. Change Your Withholding. Payroll Management System.

This is great for comparing salaries reviewing how. This calculator is a tool to estimate how much federal income tax will be withheld. See how your refund take-home pay or tax due are affected by withholding amount.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The amount of income tax your employer withholds from your regular pay. You find that this amount of 2025 falls in the.

This is great for comparing salaries reviewing how.

395 11 Federal State Withholding Taxes

Calculation Of Federal Employment Taxes Payroll Services

Paycheck Calculator Take Home Pay Calculator

How To Calculate Federal Income Tax

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Federal Income Tax Fit Payroll Tax Calculation Youtube

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Calculating Federal Income Tax Withholding Youtube

How To Calculate Payroll Taxes Methods Examples More

Solved Note Use The Tax Tables To Calculate The Answers To Chegg Com

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

How To Calculate Payroll Taxes For Employees Startuplift

Calculation Of Federal Employment Taxes Payroll Services

Solved Compute The Net Pay For Each Employee Using The Chegg Com

Payroll Tax What It Is How To Calculate It Bench Accounting

Federal Income Tax Withholding Procedure Study Com

How To Calculate Federal Income Tax